Budget 2020: FM proposes hike in Customs duties, outlines road map for more

- February 4, 2020

- 0

Budget 2020: FM proposes hike in Customs duties, outlines road map for more

Govt to trim exemptions by Sept, review customs law and procedures in line with ease of doing business

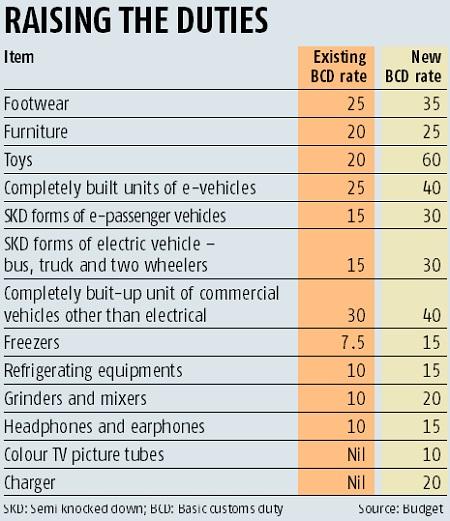

Addressing multiple objectives for supporting domestic industry, curbing non-essential imports, and raising revenue, Finance Minister Nirmala Sitharaman in the Budget on Saturday announced Customs duty hike on a range of items, including toys, furniture, electronic goods, and footwear.

Addressing multiple objectives for supporting domestic industry, curbing non-essential imports, and raising revenue, Finance Minister Nirmala Sitharaman in the Budget on Saturday announced Customs duty hike on a range of items, including toys, furniture, electronic goods, and footwear.

Besides, health cess was introduced on medical equipment to create the infrastructure for health services.

It also proposed changes in Customs law to empower the government to prohibit imports of goods that harm the economy. Earlier this prohibition was limited to imports of gold and silver.

“Our policy of Make in India has started giving dividends. India is now making world-class goods and exporting such products … Customs duty is being reduced on certain inputs and raw materials while it is being revised upward on certain goods which are being made domestically,” said Sitharaman.

Import duty on footwear has been hiked from 25 per cent to 35 per cent, while toys have seen an increase in duty from 20 per cent to 60 per cent.

The government will trim Customs duty exemptions by September (2020-21), besides reviewing Customs law and procedures in line with ease of doing business.

“Exemptions from Customs duty have been given in public interest from time to time. However, a number of these have outlived their utility or have become outdated. On review, certain such exemptions are being withdrawn… Remaining custom duty exemptions shall be comprehensively reviewed by September, 2020 for taking a view on their relevance,” said Sitharaman.

She pitched for crowd sourcing of suggestions for such reviews.

The Budget has estimated Customs mop-up to grow by 10.4 per cent in 2020-21 as against 6.1 per cent in the current fiscal year.

“Labour-intensive sectors in MSME (micro, small, and medium enterprises) are critical for employment generation. Cheap and low-quality imports are an impediment to their growth,” Sitharaman said.

She said attention had been given to restrain imports of items MSMEs here produced.

For toys, duty has been hiked on items like tricycles, dolls, and puzzles of all kinds, to 60 per cent from 20 per cent.

On furniture goods such as seats, mattress support, articles of bedding, and lamps and light fittings, import duty has been increased to 25 per cent from the current 20 per cent.

Besides, import duty on auto and auto parts has been raised by up to 10 per cent.

Import duty on platinum and palladium has been cut by 7.5 per cent for certain industrial purposes. Similarly, duty on the import of food-processing products has been raised to

100 per cent. However, the 2.5 per cent import duty on LNG and cess on gas production has been removed.

100 per cent. However, the 2.5 per cent import duty on LNG and cess on gas production has been removed.

Nirmal Singh, partner, GST, Nangia Andersen, said it was expected that there would be changes in Customs duty rates to boost the economy and the changes in basic Customs duty (BCD) rates were in that direction.

“As the finance minister talked of doubling farming income by 2022, BCD rates have been increased for certain products like butter, ghee, butter oil and other cheese, shelled walnuts, wheat seeds, maize, meslin, sunflower seeds, oil, etc,” he said.

The health cess has been imposed at 5 per cent on the import value of medical devices. However, it will not apply to devices that are exempt from basic Customs duty, including free trade agreements.

The cess cannot be paid using the duty credit scrip.

The commerce and industry ministry in its pre-Budget recommendations had proposed rationalising basic Customs or import duty on over 300 items from different sectors.

“To achieve the twin objectives of giving impetus to the domestic industry and also to generate resource for health services, I propose to impose a nominal health cess, by way of a duty of Customs, on the imports of medical equipment keeping in view that these goods are now being made significantly in India. The proceed from this cess shall be used for creating infrastructure for health services in the aspirational districts,” said Sitharaman.

As a revenue-raising measure, excise duty has been raised on cigarettes and tobacco products by way of national calamity contingent duty on cigarettes and other tobacco products.