New, IT regime a Hit in Record 7.28 crore ITRs

- September 10, 2024

- 0

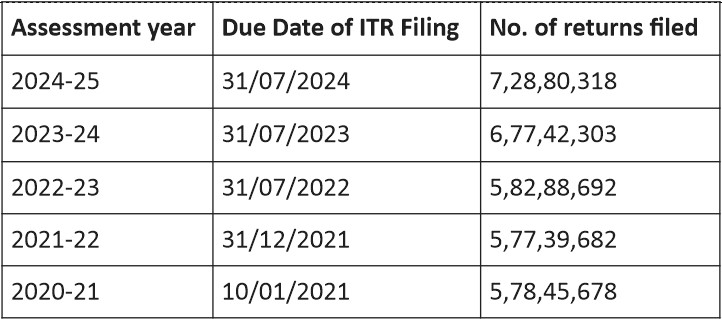

There has been a significant surge in filing of Income Tax Returns (ITRs), which resulted in a new record. Over 7.28 crore ITRs were filed for the assessment year (AY) 2024-25 by the deadline of July 31, 2024. This marks a 7.5 per cent increase compared to the 6.77 crore ITRs in AY 2023-24, filed by July 31, 2023.

The department also received 58.57 lakh individuals filing ITRs for the first time by the deadline ITRs till July 31, 2024, a fair indication of widening of tax base.

According to the data, over 72 per cent of the taxpayers have opted for the New Tax Regime this year, while the remaining 28 per cent opted for the old regime. Out of the total ITRs of 7.28 crore filed for AY 2024-25, 5.27 crore have been filed in the New Tax Regime compared to 2.01 crore ITRs filed in the old Tax Regime.

The new regime is the default system, i.e., if the taxpayer has not chosen the option, then it is automatically implemented. If a person does not have business income, then he can choose and opt any tax system, which suits him.

To make the new tax regime attractive, changes have been made in the income tax slab in Budget 2024. This change is mainly at the lower level of low tax structure, which will benefit the salaried class.

The Income Tax Department has decided not to extend the last date for filing returns beyond July 31 for the third consecutive year. Filing ITR after the deadline will attract a penalty of up to Rs 5,000. However, small taxpayers whose taxable income is up to Rs 5 lakh. Will have to pay only Rs 1000.

This time the highest number of 69.92 lakh income tax returns were filed on the last date 31 July 2024.

👇 Please Note 👇

Thank you for reading our article!

If you don’t received industries updates, News & our daily articles

please Whatsapp your Wapp No. or V Card on 8278298592, your number will be added in our broadcasting list.

Ply insight launched on March 2018 with a vision to make a platform to collaborate plywood MDF, Laminate, machinery manufactures with dealers in the Trade.

Categories

Useful Links

Follow Us