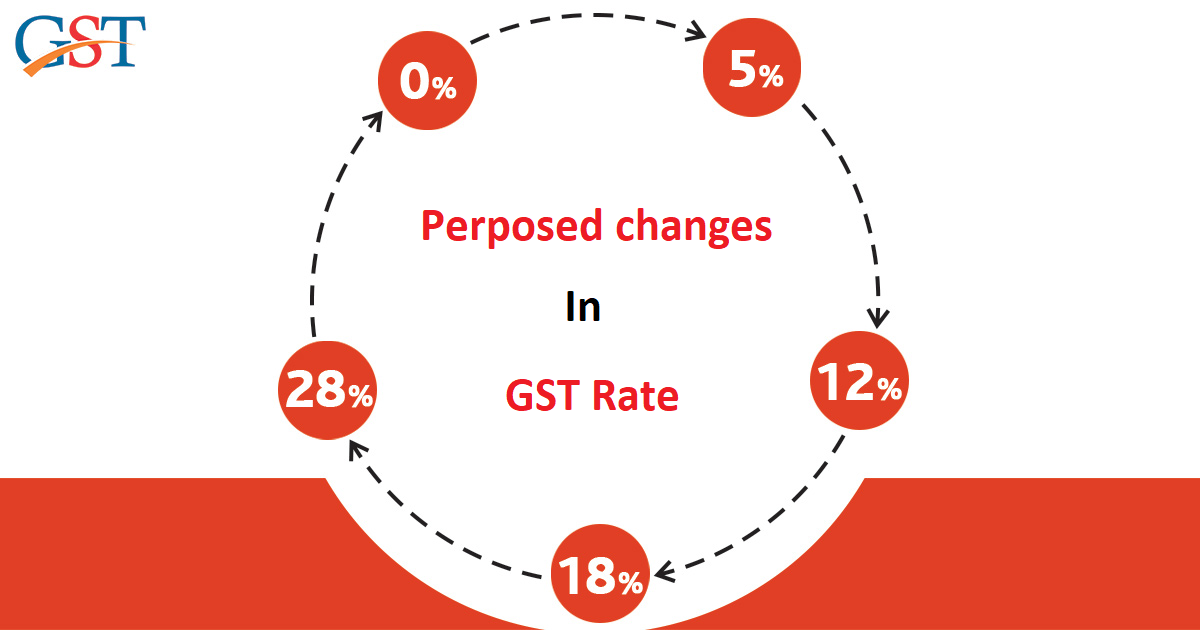

Perposed changes in GST Rate

- December 9, 2024

- 0

The group of Ministers (GoM) on Goods and Services Tax (GST) rate rationalization, led by Deputy Chief Minister, of Bihar Samrat Chaudhary, has recommended a new slab of 35 per cent for tobacco, tobacco products and aerated drinks, according to sources. At present, such products are taxed at 28 per cent.

The upcoming meeting, to be chaired by FM is expected to take up host of other issues that the GoM has recommended including an increase in GST rate on several ‘luxury’ items such as leather bags, cosmetics, watches and shoes to 28 per cent from 18 per cent now, it is learnt.

The GoM on rate rationalization has completed its report, which proposes major adjustments to tax rates on 148 items, with a particular focus on the textile industry, another sources said.

These changes are expected to generate additional revenue and will likely be reviewed in the next GST Council meeting.

The GoM has proposed a revised tax slabs for textile items as –

- 5% for items priced upto Rs 1500

- 18% for items priced upto between Rs 1500-10,000

- 28% for items priced upto above Rs 10,000

Currently, the GST structure for textiles applies a 5 per cent tax on items priced up to Rs 1,000 and a 12 per cent tax on those priced above.

The GoM has suggested reducing the GST rate on bicycles priced below Rs 10,000 from 12 per cent to 5 per cent. Additionally, the GST on exercise books and packaged drinking water over 20 liters may be lowered from 12 per cent and 18 per cent, respectively, to 5 per cent.

Currently, the GST operates under slabs of 5 per cent, 15 per cent, 18 per cent, and 28 per cent. Essential items are either exempt or taxed at the lowest slab, while luxury and demerit goods are subject to the highest slab.

Ply insight launched on March 2018 with a vision to make a platform to collaborate plywood MDF, Laminate, machinery manufactures with dealers in the Trade.

Categories

Useful Links

Follow Us