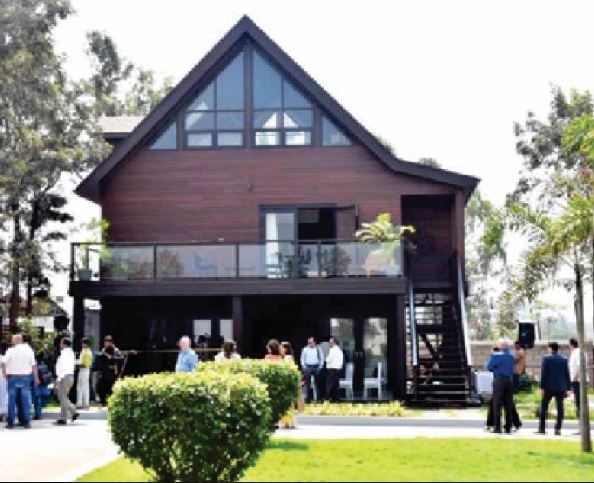

Higher Tax Sops Demanded for Home Buyers

- March 9, 2024

- 0

To spur growth in the real estate sector, developers have sought higher tax benefits for home buyers through increase in deduction of principle repayment of home loans, stretching the definition of affordable housing and a reduction in long-time capital gains tax.

Ahead of the Union Budget, the Confederation of Real Estate Developers’ Associations of India (CREDAI) has approached the reintroduction of the credit-linked subsidy scheme (CLSS) for the middle-income group, reduced stamp duty, streamlined approval processes, and subsidies for developers in vesting in affordable housing projects.

With its significant contribution to GDP, employment generation and infrastructure development, the real estate sector needs a supportive budget that addresses long-standing challenges and paves the way for sustainable growth, especially for the affording housing segment: CREDAI remains committed to working closely with the government to create a conducive environment for the real estate sector and contribute to the Indian economy’ growth.

The developed’ body has addressed some of the key fundamental issues that will provide a boost to both demand and supply through a mix of increased tax exemptions and tweaks in the definitions of affordable housing, which is bound to provide a definitions way forward as Indian real estate is projected to contribute close to 20% of Indian’s economy once it reaches the $10-trillion milestone.

At present, the ceiling of deduction for the principal repayment of a housing loan is Rs 150,000. As this deduction is clubbed with other tax-saving instruments, many homebuyers are unable to claim the benefit of the deduction.

Deduction under Section 80C for principle repayment of housing loans, according to the developers’ body, needs to be increased. Alternatively, the deduction for the principle repayment of the housing loan can be considered a separate or standalone exemption.

The definition of affordable housing as meaning homes costing up to Rs 45 lakhs, was given in 2017. As per data from the National Housing Bank (NHB), housing prices in India have risen by about 24% since June 2018, making the current cap of Rs 45 lakh unfeasible for developers to adhere to. There has also been a gradual reduction in the availability of units under Rs 50 lakh on account of inflationary pressure.