Strong Economic Resilience in Emerging Markets

- January 11, 2024

- 0

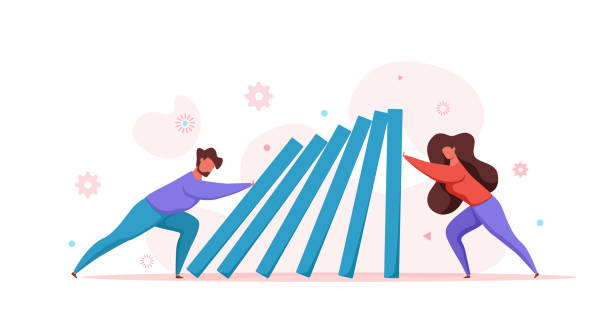

What surprised veteran analysts the most was the expected calamity that hasn’t happened, at least not yet: an emerging-market debt crisis. Despite the significant challenges posed by soaring interest rates and the sharp appreciation of the US dollar, none of the large emerging markets – including Mexico, Brazil, Indonesia, Vietnam, South Africa, and even Turkey – appears to be in debt distress, according to both the IMF and interest-rate spreads.

This outcome has left economists puzzled. When did these serial defaulters become bastions of economic resilience? Could this be merely the proverbial calm before the storm?

One notable innovation has been the accumulation of large foreign-exchange reserves to fend off liquidity crises in a dollar-dominated world. India’s forex reserves, for example, stand at $600 billion, Brazil’s hover around $300 billion, and South Africa has amassed $50 billion. Crucially, emerging-market firms and governments took advantage of the ultra-low interest rates that prevailed until 2021 to extend the maturity of their debts, giving them time to adapt to the new normal of elevated interest rates.

But the single biggest factor behind emerging markets’ resilience has been the increased focus on central-bank independence. Owing to their enhanced independence, many emerging-market central banks began to hike their policy interest rates long before their counterparts in advanced economies. This put them ahead of the curve for once, instead of lagging behind.

Will emerging markets remain resilient if, as one suspects, the period of high global interest rates persists into the distant future, thanks to rising defense spending, the green transition, populism, high debt levels, and deglobalization?

Perhaps not and there is huge uncertainty, but their performance so far has been nothing short of remarkable.